CCTV News:"Enterprising" means striving to make progress and determined to make a difference, which is exactly what China’s economy shows. Since 2024, emerging industries have accelerated their growth, and all localities have led industrial innovation with scientific and technological innovation, and cultivated and developed new quality productivity according to local conditions.

In the first quarter, the added value of the national equipment manufacturing industry increased by 7.6% year-on-year, which was 1.5 percentage points higher than the average level of industrial enterprises above designated size. Among them, the added value of the electronics industry increased by 13%, and strategic emerging industries such as the new generation information technology industry grew well.

Small sensors open up new space for industrial development

Sensor is a "neuron" in the new generation of information technology industry, and it is also one of the most important components of the Internet of Things. The sensor industry was laid out before Zhengzhou, Henan Province. Since the first quarter of 2024, the pace of industrial development has obviously accelerated.

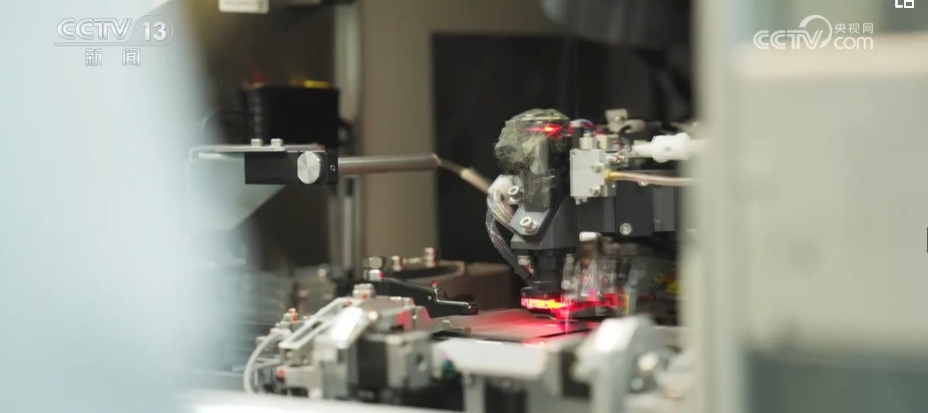

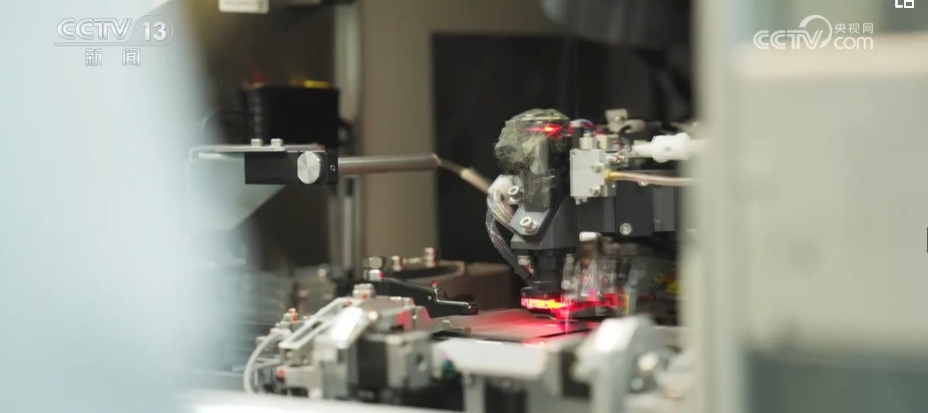

In the world’s largest passenger car door production workshop, the mechanical arm is not mechanical at all. There are all kinds of aluminum doors sent from the flexible assembly line, but the mechanical arm can always work accurately. All this is inseparable from such an intelligent vision sensor.

New scenes give birth to new demands. In Zhengzhou Intelligent Sensor Laboratory, the research team is stepping up research and development of a flexible tactile sensor, which also has the name of "electronic skin" and can be used on humanoid robots.

In Zhengzhou Intelligent Sensor Valley, on the one hand, scientific research institutions speed up the research and development of new products, and on the other hand, enterprises need to use a large number of sensors in the process of intelligent transformation. In the intelligent sensing valley, such a mini supply and demand docking will be held at any time.

Intelligent sensor valley is just one of the gathering areas of sensor industry in Zhengzhou. At present, Zhengzhou has about 3,000 sensor-related upstream and downstream enterprises with an annual output value of 30 billion yuan.

The latest data shows that in the first quarter, the added value of Zhengzhou’s industrial strategic emerging industries increased by 16.9% year-on-year, among which the added value of the new generation information technology industry increased by 21.2%.

What is the "Research Institute of Henan Stewed Cuisine"?

Three years ago, among all sensor enterprises in Zhengzhou, there were less than 1,500 enterprises that could develop and manufacture high-end sensors. But today, this number has doubled and expanded to more than 3,000. In the same three years, Zhengzhou has added more than 50 scientific research institutions related to various sensors. What new changes have a new R&D institution brought to this industry?

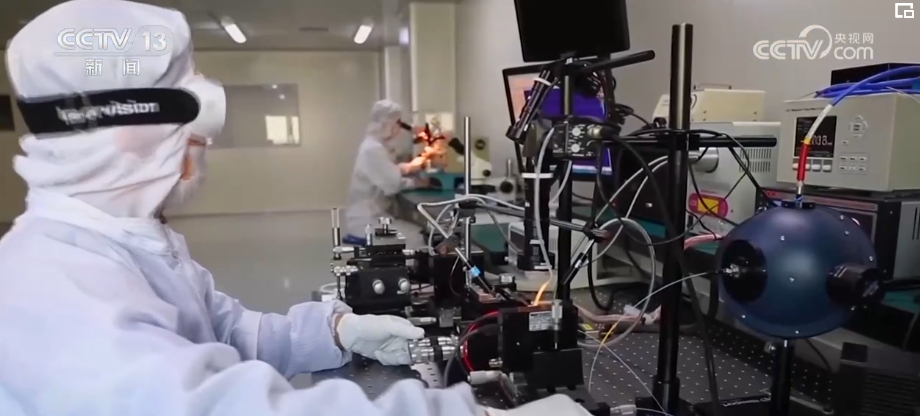

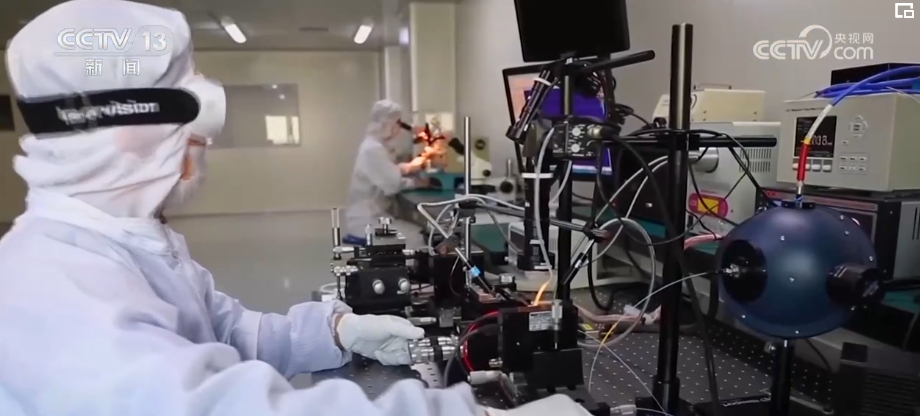

In Henan Intelligent Sensor Industry Research Institute, although everyone is wearing the same work clothes, if you look closely, the fine print on the famous brand is not the same. Some are from sensor companies, some are from universities, some are from Internet of Things companies, and some are from industry associations. They work in the same research institute, and some people call this new research and development model "Henan stewed food research institute".

According to R&D personnel, for a long time in the past, the iterative speed of sensors was slow and the development cycle was long. As sensors become more and more intelligent and involve more and more disciplines, the R&D cycle will be further lengthened and the mass production of products may become distant.

Chen Haiyong, vice president of Henan Intelligent Sensor Industry Research Institute, said that the market demand decided them to explore the research and development institutions of "stewed dishes". The laser gas sensor they completed in the first quarter involves light path, structure, circuit, technology, program algorithm and so on. They gather different people to do different parts to better meet the market demand.

Ren Hongjun, vice chairman of the sensor and Internet of Things Industry Alliance, said that with the help of various forces, "one liter and one drop" was finally realized. For example, the sensitivity of the equipment is raised from one millionth to one billionth, and at the same time, the price of the product is reduced from more than 2 million yuan to less than 1 million yuan.

Sharing production line, stepping up the construction and expansion of sensor industry

For the sensor industry in Zhengzhou, the "Henan Stewed Food Research Institute" has solved the problems of talents and technology. Now they are planning to build a better "kitchen", so that sensor-related enterprises can have a better environment for innovation and drive the industry to continue to develop and grow.

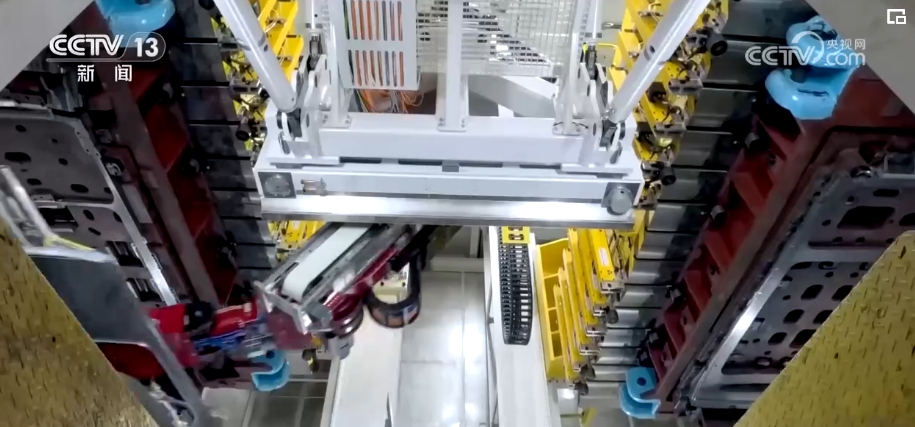

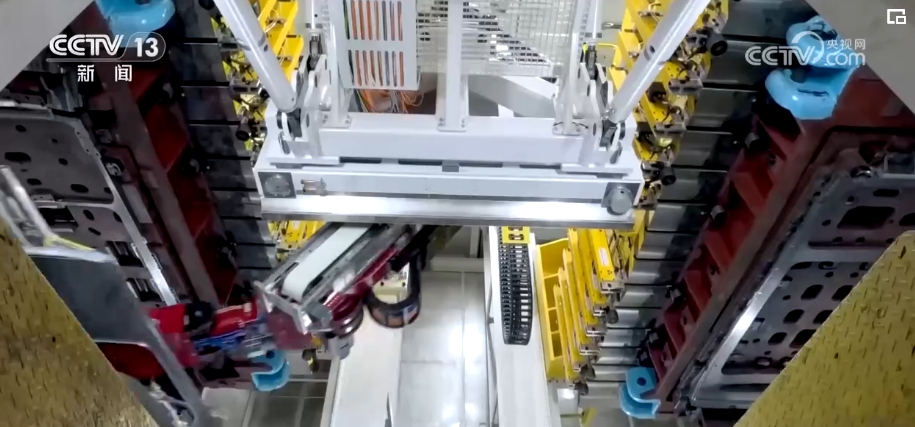

In the first quarter, the overall construction progress of this industrial park reached 30%. Soon, a high-grade workshop with an area of 51,000 square meters will be built, and a brand-new sensor production line will run here.

More specifically, this brand-new production line will be the first shared production line in Henan sensor industry, and more than 100 sets of high-end precision manufacturing equipment will be shared and shared through industrial alliances, providing pilot and small batch manufacturing services for various sensor enterprises.

With the planning and construction of new production lines, a number of new scientific research institutions dedicated to the rapid transformation of scientific and technological achievements have followed. In the first quarter of 2024, the institute accelerated the opening of technology transformation business.

Wang Demin, the chain leader of the intelligent sensor industry chain in Zhengzhou High-tech Zone, said that the new production line not only carries the public services needed by enterprises, but also is a "magnet" for the development of local industries, attracting the upstream and downstream of the sensor industry chain to accelerate convergence here, thus releasing greater synergy.

The enterprising trend of emerging industries is prominent and their competitiveness is constantly increasing.

The development of sensors and electronic information industry is only a microcosm of China’s economy. At present, while doing a good job in technological transformation and upgrading of traditional industries, all localities are accelerating the cultivation of emerging industries and future industries and accelerating the cultivation of new quality productivity. This is the biggest driving force for China’s economic transformation and high-quality development, and it is also the best starting point.

In the first quarter of 2024, a new round of large-scale equipment renovation launched by the state promoted the rapid development of equipment manufacturing industry, especially the investment in high-tech manufacturing industry achieved double-digit growth year-on-year, which significantly improved the labor production efficiency of industrial enterprises.

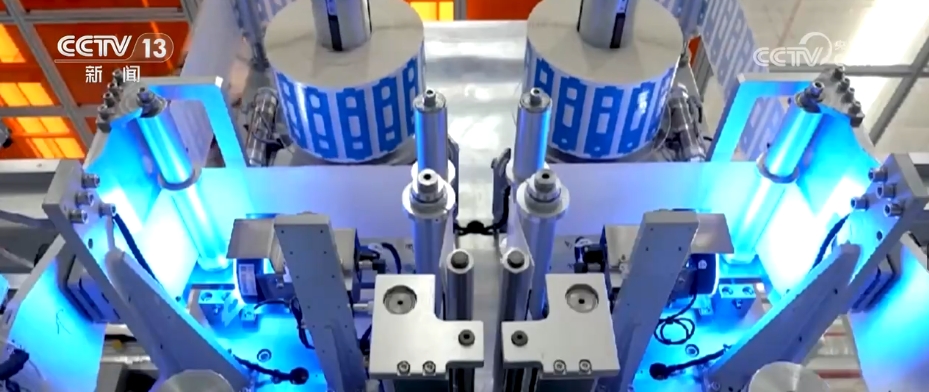

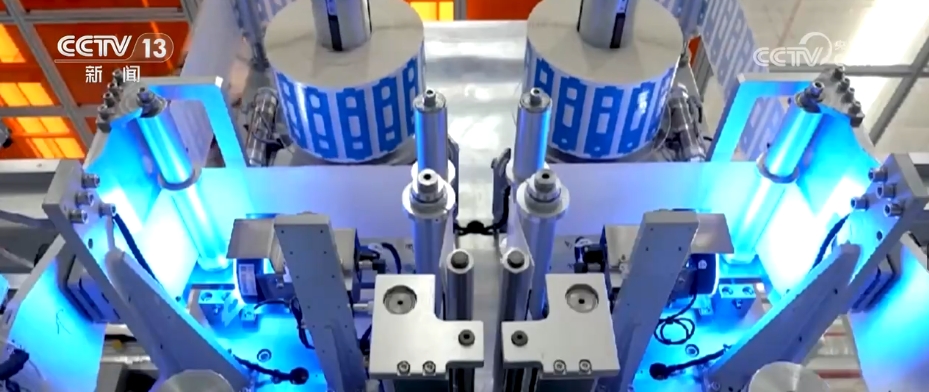

In Suzhou High-tech Zone, Jiangsu Province, this enterprise specializing in new power equipment saw a substantial increase of more than 51% in the first quarter. Since 2024, the energy storage market has exploded, making the new orders of enterprises keep flowing. In order to cope with the increasing business volume, the production line continues to be new, and 18 sets of new equipment independently developed were officially "employed" not long ago.

This automobile factory in Beijing was officially put into operation not long ago, and the professional laboratory is closely connected with the production workshop, further improving the average speed of the whole vehicle from research and development to listing.

In Zhejiang, this private aerospace enterprise built satellites by building cars, and accelerated the layout of its first commercial satellite constellation in the world.

In Heilongjiang, this new material enterprise increased its research and development in the first quarter, and processed the original glass sheet with high precision. The new flexible glass cover produced now is only 0.03 mm thick, which is equivalent to one-third of the thickness of a piece of printing paper. The orders of enterprises have been scheduled for the third quarter of 2024.

In the first quarter, new technologies, new products and new business models emerged. According to the information disclosed by the National Bureau of Statistics not long ago, the proportion of "three new economies" in GDP is increasing at a rate of 1 percentage point every year, constantly shaping the new momentum and advantages of China’s economic development.

He Jun, a researcher at the Institute of Industrial Economics of China Academy of Social Sciences, said that in the first quarter, in the industry, especially the advanced manufacturing industry represented by equipment and electronic information, the enterprising trend was even stronger. The breakthrough speed of new industries and new technologies and the pace of industrialization have been further accelerated, the proportion of strategic emerging industries in industry has been further enhanced, and the overall efficiency and competitiveness of industry have been further enhanced, indicating that industry plays a more stable role as a "ballast stone" in the national economy and the foundation of new industrialization is more solid.